The word Fintech (short for "Financial Technology") was first recorded in the 1980’s in the Sunday Times. However it was only until the financial crisis of 2007-2008, that the usage of the term became more widespread. The resulting lack of trust in the traditional financial system inspired many tech-entrepreneurs to create new start-ups (often strongly VC backed) to compete with the financial industry, which was considered before the crisis as an impregnable fortress impossible to disrupt.

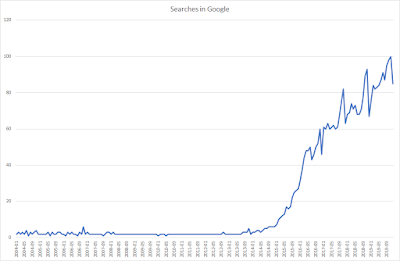

As the below Google Search graph depicts, it was however only about 5 years ago, that the term really became mainstream. As always, the more "buzzy" the term became, the more difficult it became to give a unique, commonly accepted definition for it.

Initially the term was used for tech-players competing directly with the incumbent banks, by offering banking services directly to end-customers (B2C or B2B), strongly backed by technology (such as AI, blockchain, big data…). These Fintechs aims to combine the stable, trust-worthy character of finance, with the fast, agile, experimental nature of the technology industry and combine the best of both.

Typical examples are P2P Lending (Prosper, SoFi, Lending Club, Funding Circle…), Crowdfunding (KickStarter, CircleUp, Crowdfunder, Indiegogo…), PFM tools (Mint, Betterment, Personal Capital, Digit…) and P2P payment disruptors (e.g. Venmo, Square, TransferWise…), but soon the term became adopted also in many other contexts.

Often this was also caused by new evolutions, like

Successful, pure (according to the first definition of the term) Fintech-players exploring new businesses and starting to partner with banks

Fintech players struggling to win customers (customer acquisition - cfr. my blog https://bankloch.blogspot.com/2020/06/customer-acquisition-cost-probably-most.html), being forced to partner with banks rather than compete with them

Incumbent banks starting to experiment with new approaches and technologies, often in Innovation Labs, resulting in Fintech niche-products sold by the bank or spin-offs created by the bank

Big banks slowly catching up. Some banks have already transformed themselves into strong tech-players (e.g. BBVA, DBS, Santander, KBC…) allowing them to provide products and services using similar technologies and providing similar customer-centricity and user experiences as Fintech players.

Incumbent players from other industries (like telco-players and big-tech players) also expanding to the financial services industry, e.g. Orange successfully building Orange Bank in France, Apple providing Apple Pay and launching its credit card in August 2019, Google announcing in November 2019 its intend to offer as of 2020 checking accounts in the U.S, Alibaba creating Ant Financial (formerly Alipay), Amazon offering small business loans since 2011 and offering a credit card since 2019, and Facebook announcing the Libra cryptocurrency and providing in-app payments in WhatsApp (through Facebook Pay)

Traditional financial software players (like Temenos, FIS, Fiserv, Finastra…) exploring new pricing and business models, like SaaS or even BaaS (Banking as a Service)

Tech start-ups, so called neobanks, becoming banks themselves (and losing some of their agility), thus gradually blurring the line between banks and Fintech

As a result, the word Fintech now encompasses:

The traditional Fintech players (above described), directly offering banking services to end-customers

New tech players which try to partner with banks to offer their services via their distribution channels (e.g. Tink, Mambu, Fidor…)

New tech players integrating other industries with the financial services industry (e.g. Stripe, Plaid…)

Existing financial software players (e.g. FIS, Temenos, Infosys…), which have positioned themselves as Fintech players

The incumbent banks, or at least the most innovative services offered by those banks, can be positioned as Fintech. Banks imitate, emulate and integrate FinTech business models, products and services.

The neobanks (N26, Bunq, Revolut, Atom Bank, Monzo, WeBank…)

Players with indirect links to the financial services industry, e.g. software for accountants, auditors, notaries, real estate…, which often requires connectivity with banks to retrieve balance and transactional information and to initiate payments, often also position themselves as Fintech players

In short every player (somewhat) present in the financial services sector calls itself today a Fintech player. Due to the inflation of the term, new words have been created to narrow again the definition, like Insurtech, Wealthtech, Regtech, Paytech…, but those have become overblown as well.

Instead of trying to redefine these terms, it is probably easier to realize that the digitalization and adoption of new technologies has impacted the full financial services industry, meaning there is no line anymore between banks, Fintechs and traditional banking software vendors.

This realization will help us to put everything again into perspective, i.e.

Although Fintechs have definitely woken up the industry, their direct impact (i.e. adoption rate of their services and technologies) on end-customers is not that great (yet), apart maybe of a few big ones, like TransferWise, Monzo, Coinbase, Robinhood…

Very few Fintechs providing services to end-customers are already profitable (e.g. Atom, Monzo and Revolut are still making loss), meaning that without continuous infuse of money from VCs, a lot of them will not survive. A consolidation movement, resulting from M&A’s between Fintechs or by banks and other financial players, will therefore likely follow in the coming years (as money will dry up eventually). 2019 was already a top year in M&A in Fintech (e.g. FIS acquiring Worldpay, Fiserv and First Data merging, Global Payments and TSYS merging, Intuit acquiring Credit Karma, VISA acquiring Plaid, Paypal acquiring iZettle…), but this will likely even more speed up in the coming years.

The IT budget of JPMorgan Chase, Bank of America and Citigroup combined is about fifty percent more than the total amount invested in all European FinTech start-ups in 2018 (and 2018 was a record year for Fintech investments)

Most Fintechs are only a few years old and are therefore only used to doing business in a time of economic growth. With the recession caused by the Covid-19 crisis, many of them will wake up.

The number of new Fintechs being founded is already decreasing, i.e. from 390 in 2015 to only 71 in 2018 (source Disruption House)

After the recent troublesome IPOs (or attempts for IPO) of Lyft, Uber and WeWork, the significant drops in prices and difficulties to fill funding in recent Fintech funding rounds (e.g. Lemonade and Monzo raising new capital at drops of 30-40% and Monzo not being able to raise the expected amount) and the burst of the blockchain bubble (mainly the ICO market), there is a trend in the tech-market, that VCs rethink the strategy of "growth at all costs" and go back to the basic financial KPIs like profit, gross profit per item sold, burn rate, customer acquisition cost (CAC) and customer lifetime value (CLTV). This evolution will have an impact on the ease for Fintechs to get new funding for their business.

The switch to neo-banks is still limited. Neobanks are definitely growing, but the innovative incumbent banks are seeing larger growths (at least in absolute numbers). With many big, incumbent banks starting to catch up, growth will become more complex in coming years.

This trend was enforced by the Covid crisis, which resulted in record-breaking amounts of cash flowing into the big banks (more than two-third of generated cash was deposited in the top 25 biggest banks).Although big banks still carry the burden of their legacy (often COBOL mainframe) systems (N26 claims its costs are one-sixth of the incumbent banks because of its tech-efficiency and full digital strategy), banks are deploying different strategies to reduce this negative impact, e.g.

Core-banking transformations to large established core banking platforms like T24, Midas, Finacle, Sopra Banking Platform…

Gradual replacement of the large legacy, monoliths by a micro-services based architecture (most likely deployed in the cloud)

Putting layers on top (so called systems of intelligence) of the legacy applications (like e.g. a BPMS), in which all new innovations can be developed and impacts on legacy systems can be significantly reduced (i.e. aggregate logic away from the systems of record). Once the legacy applications expose all required APIs, the legacy applications can be isolated and considered more and more as external, black box systems, which provide well the defined data and services.

Implementing Banking-as-a-Service (BaaS): a number of Fintech players are providing BaaS services, allowing banks to outsource a large part of their cumbersome legacy back-end systems. E.g. Mambu (powering Oak North bank, New10 and N26), Solaris Bank (powering Modifi and CrossLend), Plaid (enabling Prosper, SoloFunds and Gusto), Fidor Solutions (powering Fidor Bank and O2 Telefonica)…

With the above in mind, it is important to further improve the relationship between all parties, calling themselves Fintech players, including the incumbent banks. The us-versus-them thinking should come to a hault, as such thinking can never lead to constructive partnerships and successful future M&As. Especially as this divide has become somewhat artificial, now that all players are adopting the same techniques, methodologies and business models. The image of all incumbent banks being slow and resistant to change and Fintechs being disruptive and agile, has become caricatural and stereotypical.

Nonetheless when I look at the active users on Fintech-oriented platforms like Finextra or FinancialIT or to the participant lists of the typical Fintech conferences, the lack of employers from large banks (with the exception of a few) is striking. As a result big banks are still missing out on insights in the new evolutions, while Fintech representatives are preaching to the choir.

Instead it would be better to create again 1 financial services ecosystem, where there is true collaboration between the banks and the tech vendors and where Fintech start-up competitions and Fintech labs (incubators, accelerators…) organized by large banks, are not just a marketing tool, but become a fundamental part of the bank’s organization (meaning a much stronger integration between the innovation and the traditional IT teams).

In such partnerships everybody can profit. Fintechs can get fast access to a large customer base, a strong and well-known brand, cheap funding and extensive knowledge and experience on risk management, regulation and other vital domains, while banks can profit of a continuous inflow of new ideas, services and products, which they can try out (i.e. check their market-fit) in a cheap and controlled way. Let’s hope that soon we can talk again of one Financial Services industry.

This comment has been removed by the author.

ReplyDeleteWat een intrigerende titel! "Fintech is dead, long live Fintech" roept meteen vragen op en prikkelt de nieuwsgierigheid. Tegelijkertijd ben ik gefascineerd door het idee van het vinden van nieuwe wegen binnen de Fintech-wereld.

ReplyDeleteAan de zijlijn van deze discussie wil ik graag het belang van een sterke online aanwezigheid benadrukken. In een tijdperk waarin technologie en financiën hand in hand gaan, is het cruciaal om op te vallen met een professionele website. Goedkope website laten maken Daarom raad ik ten zeerste aan om te investeren in een goedkope website laten maken, waarmee jullie je visie en innovaties effectief kunnen communiceren naar een breder publiek.

Boost your Instagram presence with our reliable services where you can buy custom Instagram comments, buy Instagram likes and comments, and enhance engagement on every post. We offer options to buy Instagram custom comments tailored to your content, ensuring authentic interaction. For video creators, you can also buy Instagram reels comments to attract more attention. Stay ahead effortlessly when you buy automatic Instagram comments, designed to deliver consistent engagement and maximize your social media growth.

ReplyDeleteprivate golden circle tour Iceland: "Our golden circle tour Iceland gave us a truly luxurious and personalized experience. We traveled in comfort, had a fantastic driver who knew all the secrets spots, and didn't feel rushed at all. Highly recommend this premium option." (50 words)

ReplyDeleteI really enjoyed reading this article—fantastic work! The content is informative and well-structured. For anyone curious about Qadiani, check out Eman e Kamil for more information.

ReplyDelete